As it turns out, the free market will solve all our problems.

Because that’s worked out so well up till now.

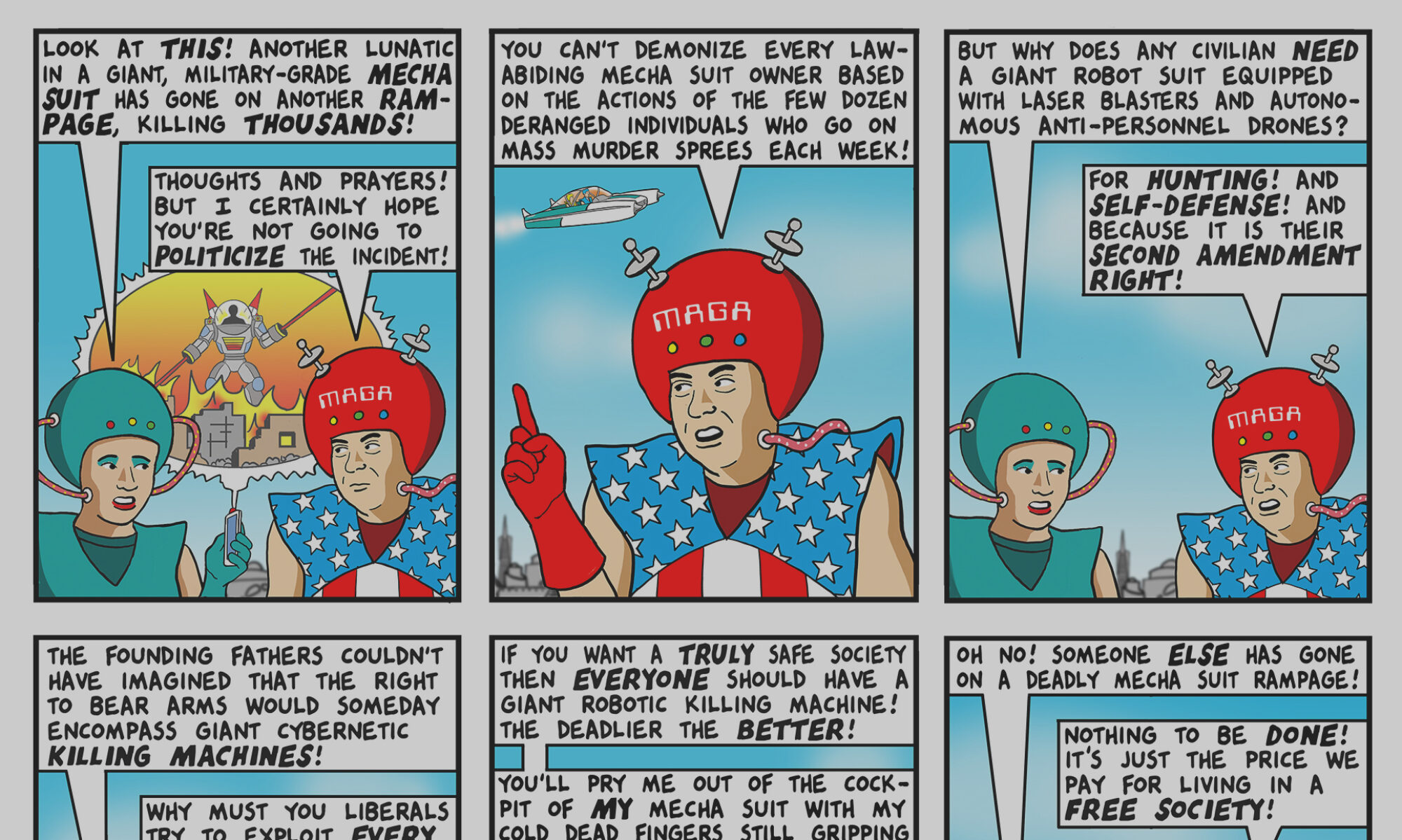

BY TOM TOMORROW

As it turns out, the free market will solve all our problems.

Because that’s worked out so well up till now.

You’ll probably see a lot of variations on the theme in the next couple of days.

During World War I, Americans were exhorted to buy Liberty Bonds to help their soldiers on the front.

Now, it seems, they will be asked to come to the aid of their banks — with the added inducement of possibly making some money for themselves.

As part of its sweeping plan to purge banks of troublesome assets, the Obama administration is encouraging several large investment companies to create the financial-crisis equivalent of war bonds: bailout funds.

Dean Baker, in this USA Today op-ed about Social Security, points out something no one else has:

In effect, the cutters are proposing that the government default on the bonds held by the Social Security trust fund: U.S. government bonds that were purchased with money raised through the designated Social Security tax.

It is truly incredible, and unbelievably galling, that anyone in a position of responsibility would suggest defaulting on the government bonds held by the Social Security trust fund at the precise moment that the government is honoring trillions of dollars of bonds issued by private banks.

While the government has no legal or moral obligations to pay off the banks’ debts to wealthy investors (who presumably understood the risks they were taking), the Social Security bonds carry the full faith and credit of the U.S. government.

It is understandable that people are angry. We have a government and an elite that never stop looking for ways to take money from ordinary workers and redistribute it upward to the richest people in the country.

In case you’ve missed it, the Federal Reserve has guaranteed gigantic amounts of bonds issued by banks (see “bank debt” here). Thus, as Baker says, the Social Security cutters don’t just want us to default on U.S. government bonds essentially belonging to Social Security recipients. They want us to do that at the same time we’re paying off Citigroup’s bonds.

The mad tea party!